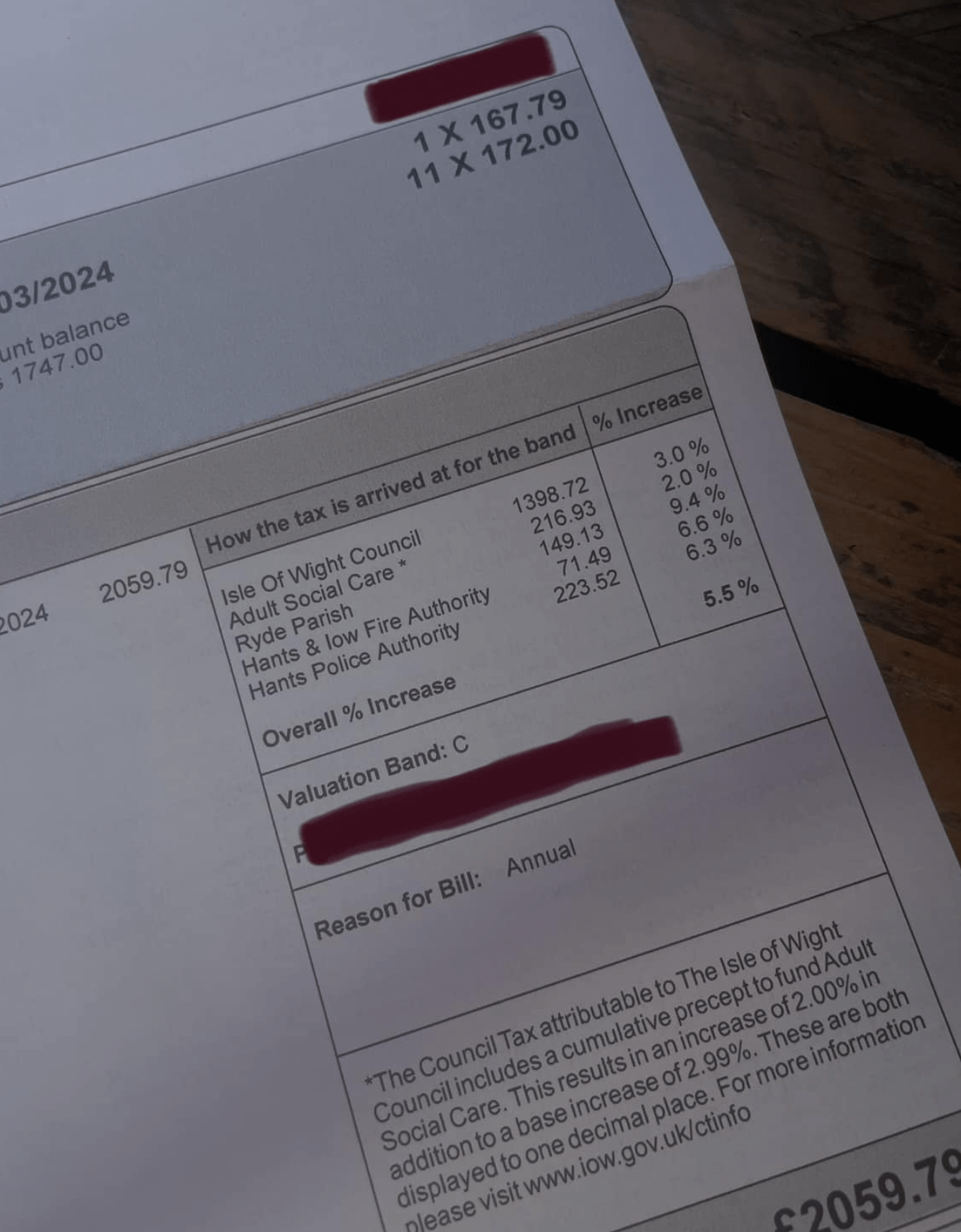

If you are responsible for paying Council Tax and are on a low income, you may be eligible for a Council Tax Reduction. This assistance can help reduce or, in some cases, cover your entire Council Tax bill. However, eligibility and the amount of reduction depend on a variety of factors.

Who Is Eligible for Council Tax Reduction?

While UK councils run their own Council Tax Reduction schemes, they generally follow a similar format. You may be eligible for a reduction if you meet the following criteria:

- Income and Capital: Your income and savings (capital) must be below a certain level. If you are on a low income or claiming benefits, you could qualify for help.

- Benefits: You could get a reduction if you’re receiving benefits such as Income Support, income-based Jobseeker’s Allowance, Income-related Employment Support Allowance, or the ‘guarantee credit’ of Pension Credit. Universal Credit recipients may also be eligible.

- Employment Status: You can apply whether you are employed, unemployed, renting, or a homeowner.

- Household Circumstances: Factors such as the number of children in your household, your partner’s income, and whether other adults live with you can impact your eligibility.

- Location: Each local council runs its own scheme, so where you live will influence how much help you can receive.

If eligible, your Council Tax bill could be reduced by up to 100%, significantly easing the financial burden.

Who Isn’t Eligible for Council Tax Reduction?

There are specific circumstances in which individuals are not eligible for Council Tax Reduction. These include:

- Savings: If you have savings of over £16,000, you typically won’t qualify for Council Tax Reduction, unless you are aged 60 or over and receiving the ‘guarantee credit’ of Pension Credit.

- Asylum Seekers and Sponsored Individuals: Most asylum seekers and individuals sponsored to be in the UK do not qualify for Council Tax Reduction.

How to Apply

To apply for Council Tax Reduction, visit your local council’s website, where you can find detailed information on their specific scheme and how to submit your claim. Be prepared to provide details about your income, savings, household circumstances, and benefits.

Important Considerations

- Council Schemes Vary: Since each local council runs its own scheme, eligibility criteria and the amount of reduction can differ. It is essential to check with your specific council to understand what help is available.

- Household Income Matters: Your total household income, including your partner’s earnings and any pensions or savings, will be taken into account when assessing your eligibility.

- Benefits Entitlement: If you receive certain benefits, you may automatically qualify for the maximum reduction, which could significantly lower your Council Tax bill.

For those struggling to keep up with Council Tax payments, Council Tax Reduction can provide essential financial relief. Be sure to explore your options and apply if you believe you may be eligible.

To find out more, visit your local council’s website or contact their offices directly for assistance with your application.