Thousands of people, including elderly residents Margaret and David Fee, remain without answers and compensation two years after the collapse of Safe Hands Plans Ltd, a pre-paid funeral firm. The couple, from Ratby, Leicestershire, are among 46,000 affected customers who invested their savings to secure funeral plans that would ease the burden on their loved ones.

The Fees, both 78, paid £2,745 each from David’s pension fund in 2015 for their funeral plans, assured by Safe Hands that their money was protected. However, the company went into administration in March 2022, just months before new regulations by the Financial Conduct Authority (FCA) came into effect.

Despite an ongoing investigation by the Serious Fraud Office (SFO), which began in October 2023, the couple has yet to recover any of their money. “We never thought we’d be in this position to pay off something monthly again,” Margaret said. “Now, there’s nothing left for treats.”

Customers like Margaret and David were offered an option to renew their plans with Dignity or Co-op for half the original price. The couple paid for one plan upfront using David’s pension, while the other was set up on a monthly plan, putting them in a financially vulnerable position.

The SFO’s investigation into Safe Hands continues, but customers remain in limbo. The administrators, FRP Advisory, have so far issued four progress reports since taking over but have yet to return any money to customers. The most recent report in May mentioned “substantial progress” but confirmed that no funds had been returned.

Wider Impact and Calls for a Public Inquiry

Gill Marshall, another customer from Grantham, Lincolnshire, paid £4,000 for her plan with Safe Hands after struggling to pay for her husband’s funeral when he passed away suddenly in 2012. After receiving a letter in 2022 about the company’s collapse, she, like many others, found herself without a plan or the funds to secure another one.

“I just didn’t want my children to be in that position,” Marshall said. “Now, I’m left with nothing.”

Consumer group Fairer Finance is calling for a public inquiry into the company, citing warnings it made to the Treasury and FCA in 2017 about the financial risks associated with Safe Hands. It believes the Treasury and FCA could have acted sooner to protect planholders.

The FCA responded by stating that it had limited powers over unregulated firms at the time, while the Treasury said, “Once concerns were raised about the funeral plan market, we made it illegal to sell pre-paid funeral plans without authorisation from the Financial Conduct Authority – protecting 1.6 million customers and their families.”

Offshore Investments and Missing Funds

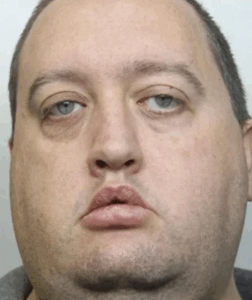

Safe Hands’ collapse exposed a series of questionable financial transactions. FRP Advisory’s documents reveal that £45.1 million was invested in the Cayman Islands, a jurisdiction outside UK control. Additionally, in 2018, the company issued a loan of £3.5 million to its previous owner, Malcolm David Milson, without any specified repayment terms.

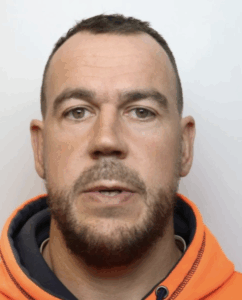

Attempts to reach Milson and another former owner, Richard Philip Wells, for comment, have been unsuccessful. Financial expert Lara Gee from the University of Nottingham expressed concern over the company’s lack of preparation for regulation, despite its involvement in industry discussions since 2017.

“The company had time to align its investments with upcoming regulations, as other providers did,” she noted. “The fact they didn’t raises serious questions.”

As the SFO continues its active investigation, those affected are left with little consolation. Margaret Fee expressed her frustration, stating, “They’ve caused so much pain to such a vulnerable age group. They should be criminally prosecuted.”

With a new government in place, Fairer Finance plans to push for a public inquiry to provide answers and accountability for the thousands left financially stranded.